Income Tax People: Your Essential Guide To Filing, Refunds, And What's New For 2025

Dealing with income tax can feel like a big puzzle for many folks, and that's perfectly okay. So, whether you're just starting out in the working world or have been at it for years, knowing about income tax is pretty important. This guide is here to help you get a better grip on what income tax is, why we have it, and how it impacts you directly, which is something many of us wonder about, actually.

You see, most individuals and even businesses are required to pay federal income taxes each year, and there can be penalties if you don't, which is a bit of a serious thing. Fortunately, though, there are multiple ways to pay what you owe, making the process a little less stressful for people. This article aims to break down the key parts of income tax for you, making it all seem a bit clearer, you know?

From understanding what a tax refund truly means to learning about free help programs, we'll walk through the essentials. We'll also touch upon some of the newer changes, like the income tax brackets for 2025, which can really affect your finances. It's about empowering you with good information, so you feel more confident about your tax responsibilities and opportunities, in a way.

- Descargar Musica Youtube

- Cardi B Meme

- Cookie Butter Dunkin

- Mexico Contra Argentina

- Organic Chemistry Tutor Face

Table of Contents

- What is Income Tax and How Does It Work?

- Why We Have Income Tax

- Paying Your Income Tax: The Pay-As-You-Go System

- Getting Your Tax Refund: What It Means

- Finding Help With Your Taxes: Free Assistance Programs

- Choosing Tax Software: A Look at Popular Options

- New Tax Brackets for 2025: What's Changing

- Your Taxpayer Rights: The Taxpayer Bill of Rights

- A Global View of Income Tax

- Common Questions About Income Tax People

What is Income Tax and How Does It Work?

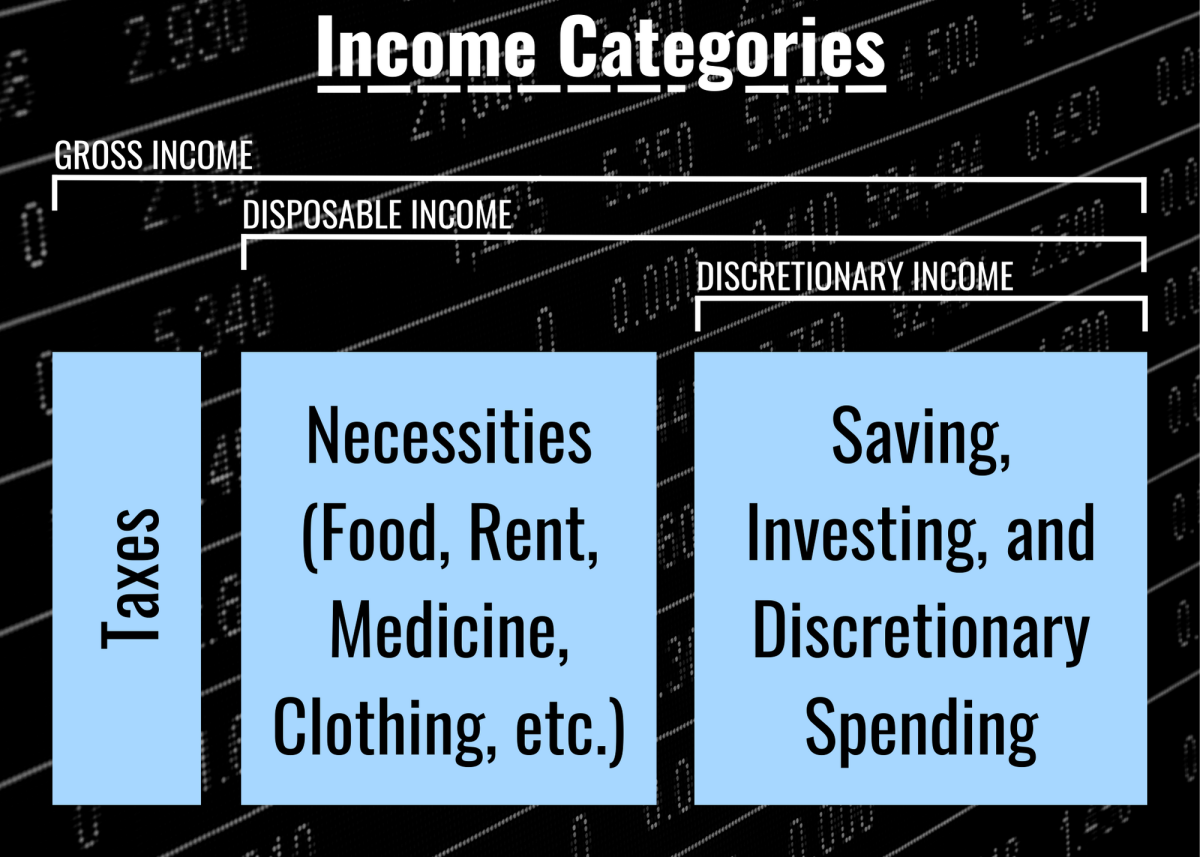

Income tax is, basically, a portion of the money you earn that goes to the government. It's a system where people contribute based on their earnings, and it works in a pretty straightforward manner, you know? The more you make, typically, the more you might contribute, though there are different rates for different income levels, which is something to keep in mind.

This kind of tax applies to most individuals and also to businesses. It’s a yearly requirement, and if you don't meet it, there can be penalties, which is a good reason to stay on top of things. The idea is that everyone contributes a fair share to support public services, which is what the government uses these funds for, in some respects.

For example, someone earning around $35,000 might pay about 10 percent in tax. On the other hand, a person earning $100,000 could pay closer to 30 percent, which shows how rates can change with income. These percentages are just examples, of course, but they give you a general idea of how it often works for income tax people.

- Asian Mullet Haircut

- Classy Demure Mindful Dress To Impress

- Real Trap Shit

- Is Dove Cameron Gay

- Skeleton Dress To Impress

The system is set up so that you pay most of your tax throughout the year, as you actually receive your income. This is different from waiting until the end of the year to pay it all at once, which would be a pretty big lump sum for many. There are, in fact, two main ways this "pay-as-you-go" system usually happens, making it a bit easier to manage your money.

Why We Have Income Tax

You might wonder why people are taxed at all, and it's a very fair question. Taxes are, simply put, the main way governments get their money. They use these funds to provide all sorts of public services, things like roads, schools, and public safety, which benefit everyone in the community, so it's a very important source of revenue.

These taxes can be either direct or indirect. Income tax, as you might guess, is a direct tax because it's taken directly from your earnings. Other taxes, like sales tax on things you buy, are indirect, because they are added to the price of goods and services. Both types are vital for funding what a country needs to operate, you know.

In some places, like the UK, people start paying the basic rate of income tax once their earnings go over £12,570. If their income goes above £50,270, they start paying the higher rate, which shows a clear tiered system. This kind of structure is quite common globally, with different thresholds and rates depending on the country, too.

It’s interesting to note that not everyone always owes income taxes. For instance, the Tax Policy Center mentioned that in 2020, about 107 million households, which is around 61% of taxpayers, actually owed no income taxes. This was a jump from 76 million, or 44% of taxpayers, in 2019, which is a rather significant change to consider.

Paying Your Income Tax: The Pay-As-You-Go System

The main idea behind income tax is that you pay it as you earn it, rather than waiting until the very end of the year to make one big payment. This method makes it much more manageable for most people, allowing for steady contributions instead of a sudden large bill. It's a system that, in a way, smooths out your financial obligations over time.

There are typically two primary ways this "pay-as-you-go" system works for income tax people. One common method is through payroll withholding, where your employer takes out a portion of your earnings each payday and sends it directly to the tax authorities. This is how many salaried employees handle their tax obligations, and it’s quite convenient, actually.

The other main way is through estimated tax payments. If you're self-employed, a freelancer, or have other income sources not subject to withholding, you usually need to calculate and pay your taxes in installments throughout the year. This ensures that you're still contributing regularly, much like those with payroll deductions, which is a key part of staying compliant, you know.

It's important to keep up with these payments, as federal income taxes are required each year for most individuals and businesses. If these payments aren't made on time, penalties may apply, which is something nobody wants. So, knowing your payment responsibilities is a big part of being an income tax person, in some respects.

You can learn how to make a payment, check the status of your refund, and do more related to your income tax return through official channels. There are multiple ways to pay, which can include online options, direct debit, or even mailing in a check, giving people some flexibility in how they handle their money, very conveniently.

Getting Your Tax Refund: What It Means

A tax refund is something many income tax people look forward to, and it's simply a reimbursement from the state or federal government. It happens when you've paid more in taxes than you actually owed for the year, which is a pretty good outcome for taxpayers. This often occurs because too much money was taken out of your paychecks throughout the year, you know.

When your employer withholds taxes from your salary, they estimate how much you'll owe based on the information you provide. Sometimes, that estimate is a bit higher than your actual tax liability, leading to an overpayment. That extra money then comes back to you as a refund, which is, in a way, like getting a savings account payout.

The process of getting a refund is part of filing your income tax return. When you file, you calculate your total income, deductions, and credits, and then determine your actual tax bill. If the amount you've already paid (through withholding or estimated payments) is more than what you owe, you get the difference back, which is a nice bonus for many.

Checking the status of your refund is usually quite simple, with online tools provided by tax authorities. This allows you to track when your money might arrive, which can be very helpful for planning. It's a system designed to ensure fairness, so if you've overpaid, you do get your money back, as a matter of fact.

Finding Help With Your Taxes: Free Assistance Programs

Preparing your income taxes can sometimes feel a bit overwhelming, especially if your financial situation is complex. The good news is that there are free tax assistance programs available, which can be a real lifesaver for many income tax people. These programs offer valuable support and guidance, which is something a lot of folks appreciate.

For example, if you needed help preparing your 2019 taxes, there were, and still are, programs sponsored by the IRS. One such program is VITA, which stands for Volunteer Income Tax Assistance. This program helps people with lower incomes, disabilities, and limited English proficiency with their tax returns, providing a very important community service.

Another helpful program is TCE, or Tax Counseling for the Elderly. As the name suggests, TCE provides free tax help specifically for individuals who are 60 years of age and older. These volunteers are certified by the IRS and can assist with various tax questions and return preparation, which is a fantastic resource for older adults, too.

These programs are staffed by volunteers who are trained and certified to help. They can guide you through the filing process, answer your questions, and ensure your return is accurate. It's a way to get expert help without having to pay for it, which makes tax season a lot less stressful for many people, you know.

Beyond these free programs, there are also tax consulting services available. For example, Hodder Tax Consulting, founded in 2020, exists to provide income tax preparation, advising, and research to businesses and individuals. They believe strongly in the value of hard work, offering professional help for those who might need more specialized advice, which is pretty common for businesses.

Choosing Tax Software: A Look at Popular Options

For many income tax people, using tax software is the preferred way to file. These programs guide you step-by-step through the process, making it simpler to input your information and calculate what you owe or what refund you might get. We've rated and reviewed some top tax software providers to give you an idea of what's out there, which can be very helpful.

Some of the widely recognized names include TurboTax, H&R Block, TaxSlayer, and TaxAct. Each of these options offers different features, pricing structures, and levels of ease of use. Your choice might depend on how complex your taxes are, or what kind of support you're looking for, in a way.

TurboTax, for instance, is often praised for its user-friendliness and comprehensive guidance, which can be great for those who want a lot of hand-holding. H&R Block also has a strong presence, offering both software and in-person assistance, giving people different ways to get their taxes done, too.

TaxSlayer and TaxAct are often seen as more budget-friendly options, providing solid functionality without as many bells and whistles as their pricier counterparts. They can be a good fit for people with simpler tax situations who still want to file electronically and accurately, which is a pretty common need, actually.

The complexity of your taxes really does play a role in which program might be best for you. If you have a straightforward W-2 income, almost any software can work. But if you have investments, self-employment income, or other unique situations, you might want a program with more robust features, which is something to consider for income tax people.

New Tax Brackets for 2025: What's Changing

Staying informed about changes to income tax rules is a smart move for all income tax people. This includes knowing about new tax brackets, which directly affect how much of your income falls into different tax rate categories. You can discover the new income tax brackets for 2025 on places like Kiplinger, which is a good source for financial news, you know.

Tax brackets are essentially income ranges that are taxed at specific rates. As your income goes up, different portions of it might be taxed at higher rates. These brackets are often adjusted each year for inflation, which means the income thresholds can shift, impacting how much tax you pay, in some respects.

For example, knowing the 2025 brackets helps you understand how much of your earnings will be subject to, say, the 10% rate versus a higher rate like 20% or 30%. This information is vital for financial planning and making informed decisions about your money, which is something many people are interested in.

Keeping an eye on these updates helps you stay informed about changes affecting your finances. It allows you to anticipate your tax obligations and plan accordingly, which can prevent surprises later on. This proactive approach is very beneficial for managing your personal finances effectively, as a matter of fact.

It's worth noting that while the general structure of tax brackets remains, the exact income figures for each bracket can change. These adjustments reflect economic conditions and government policy, so checking reliable sources for the most current information is always a good idea for income tax people, too.

Your Taxpayer Rights: The Taxpayer Bill of Rights

When you're dealing with income tax matters, it's good to know that you have certain protections and rights. The Taxpayer Bill of Rights, or TBOR, is a very important document that outlines 10 fundamental rights taxpayers have when they interact with the Internal Revenue Service, which is a key thing for people to be aware of.

This document acts as a cornerstone, ensuring that you are treated fairly and respectfully throughout the tax process. It covers things like the right to be informed, the right to quality service, and the right to pay no more than the correct amount of tax. These rights are there to protect you, which is a pretty comforting thought for income tax people.

Knowing your rights can help you feel more confident and secure when handling your tax affairs. It means you can ask questions, seek clarification, and expect certain standards of service from the tax authorities. This empowers you to engage with the system from a position of knowledge, in a way.

For instance, one right is to appeal an IRS decision if you disagree with it. Another is the right to privacy and confidentiality, meaning your tax information is protected. Understanding these protections can really make a difference in how you approach your tax responsibilities, you know.

The Taxpayer Bill of Rights is designed to create a more transparent and equitable relationship between taxpayers and the IRS. It's a reminder that even though paying taxes is a requirement, you still have important rights that are recognized and upheld, which is something every income tax person should remember.

A Global View of Income Tax

While much of the discussion about income tax might focus on one country, it's actually a global concept. Different nations have their own unique income tax systems, with varying rules, rates, and ways of collecting revenue. It's interesting to see how these systems compare, which can give you a broader perspective on taxation.

For example, we briefly touched on income tax in Ghana, which includes details about employer contributions and tax treaties. Tax treaties are agreements between countries to avoid double taxation, meaning you don't pay tax on the same income in two different places, which is very helpful for international workers or businesses.

Similarly, the income tax system in India has its own set of rules, including applicable ITR forms and slab rates. For creators earning money through platforms like Twitter (now X), knowing how this income is taxed in India, including compliance tips, is quite important, as a matter of fact.

These international examples highlight that while the core idea of income tax is similar everywhere – governments collecting revenue from earnings – the specifics can vary greatly. This includes what income is taxed, at what rates, and how it's reported, which is something to keep in mind if you have global income or interests.

Understanding these different approaches can be beneficial for anyone with international financial activities or simply a curiosity about how other parts of the world handle their public finances. It shows that the concept of "income tax people" is truly universal, though the details are always locally specific, you know.

Common Questions About Income Tax People

What is income tax and how does it work?

Income tax is a required payment to the government from individuals and businesses based on their earnings. It works by collecting a portion of your income throughout the year, often through payroll deductions or estimated payments, rather than all at once at the year's end. The government uses these funds to pay for public services, which is a pretty common practice worldwide, actually.

Are there programs to help with income tax preparation?

Yes, there are free programs that can help with income tax preparation. For instance, the IRS sponsors programs like Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE). These programs offer free, certified assistance to eligible individuals, making it easier for many income tax people to file their returns accurately and on time, which is a great resource, you know.

How do tax refunds happen?

Tax refunds happen when you have paid more in taxes than you actually owed for the year. This usually occurs because too much money was withheld from your paychecks by your employer, or you overpaid your estimated taxes. When you file your return, the government calculates your actual tax bill and sends you back any excess money you paid, which is a nice bonus for many, in a way.

Understanding income tax is a key part of managing your personal finances. We hope this guide has made the process a bit clearer for you, covering everything from what income tax is to how refunds work and where to find help. Taking the time to learn about your tax responsibilities and rights can truly empower you to handle your money with more confidence. For more details on specific tax topics, you can learn more about income tax regulations on our site, and also find helpful information about tax filing deadlines to keep you on track. Staying informed is always a good plan, you know.

Detail Author 👤:

- Name : Chanel Kirlin

- Username : isidro30

- Email : kiara.koelpin@lynch.biz

- Birthdate : 1985-08-03

- Address : 935 Opal Neck Port Ronaldo, OK 13016-2137

- Phone : (463) 408-6166

- Company : Kirlin, Borer and Stamm

- Job : Rough Carpenter

- Bio : Qui laborum qui neque ab laboriosam unde. Illo amet fugit qui. Voluptatum aut omnis eveniet tempora nisi voluptas ut. Quas incidunt qui accusantium iste laudantium non qui fugiat.

Socials 🌐

facebook:

- url : https://facebook.com/mgoodwin

- username : mgoodwin

- bio : Aut dignissimos quos amet hic voluptatem eum ut possimus.

- followers : 3755

- following : 692

twitter:

- url : https://twitter.com/mgoodwin

- username : mgoodwin

- bio : Quo non rerum exercitationem numquam aut reprehenderit. Sapiente doloribus et ipsum non consequatur eum.

- followers : 5037

- following : 1614

tiktok:

- url : https://tiktok.com/@myahgoodwin

- username : myahgoodwin

- bio : Incidunt dolores numquam placeat id qui ut. Sint alias qui neque dolorem.

- followers : 5307

- following : 663

linkedin:

- url : https://linkedin.com/in/goodwin1979

- username : goodwin1979

- bio : Debitis officia nihil fuga in.

- followers : 2184

- following : 2295